Our Real Estate investing philosophy is based on two main items. First a strategic method of investing that takes out speculation and luck. Second we use proven Real Estate fundamentals to determine where and what to invest in.

Our Real Estate investing philosophy is based on two main items. First a strategic method of investing that takes out speculation and luck. Second we use proven Real Estate fundamentals to determine where and what to invest in.

Remember, Real Estate is not a get rich quick scheme. Successful Real Estate investing requires a long term vision and patience to watch as your values grow, your mortgages get reduced over time and your cash flow from your tenants increases over the years.

To find out more about this, read about our strategies and the Real Estate fundamentals we follow below.

Investment Strategy

Our investment strategy is simple:

First, what we don’t do: we do not invest based on ‘hot tips’ or on someone’s opinion.

Second, what we do: we follow the maxim ‘numbers don’t lie’ to guide our investment strategy. We invest in markets that have long-term business fundamentals.

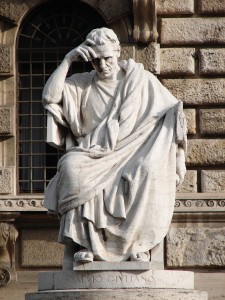

Where did we devise our strategy? By learning from the best. Warren Buffet is known as the greatest investor of all time. His strategy has been to carefully choose stocks based on long-term business fundamentals and hold them as long-term plays. He didn’t speculate with start-ups like Microsoft, Google or E-bay, he committed capital to investments only when the long-term business fundamentals were there. We have taken Buffet’s strategy and applied it to real estate.

Although the key drivers may differ between real estate and stocks, the strategy of investing in long term fundamentals remain the same.

What are Real Estate Fundamentals?

The Real Estate market, like any other, is driven by supply and demand. Here are the fundamentals we look for when we invest:

In Migration – Markets that are currently experiencing and will continue to experience

above average population growth due to a significant number of people moving into a region. This increase in population creates an increased demand for housing.

Job Growth & Employment – We look for markets with above average job growth that has strong employment. A market may have excellent job growth however if un-employment is high, then jobs are likely to be consumed by the local population and not require in-migration.

Wage Increases – We look for markets that are experiencing above average increases in wages and salaries. The concept here is simple, if people are earning more they can afford to pay more for housing.

Diverse Economies – Investing in smaller markets with one or two major employers, such as coal mining towns has the potential for housing demand to plummet should the major employer shut down. Markets with a large number of small businesses are signs of diversification.

Housing Affordability – The affordability index is the percentage of pre-tax household income that goes toward home ownership costs, including mortgage payments, utilities and taxes. We look for markets that have an affordability index between 25 – 40%.

Housing Starts – Markets that are experiencing higher than average housing starts are usually a sign that all real estate prices will be increasing.

New Home Price Index – As the costs increase to build new homes, the statistics show that resold homes enjoy a higher percentage of appreciation than new homes.

Vacancy Rates and Rents – Acquiring positive cash flow properties is one of our strategies. We look for markets that show signs of continued low vacancy rates and increasing rents.

Local Government – We target pro-active governments that are focused on creating a growth atmosphere for their region.